Social Good Award

Gabriella Woodman Jordan Timoti Dylan Birnie Alexandra Paton Super Savvy

-

Tauira / Students

Gabriella Woodman, Jordan Timoti, Dylan Birnie, Alexandra Paton -

Kaiako / Lecturers

Tatiana Tavares, Marcos Mortensen Steagall

-

School

AUT Art + Design 2025

Description:

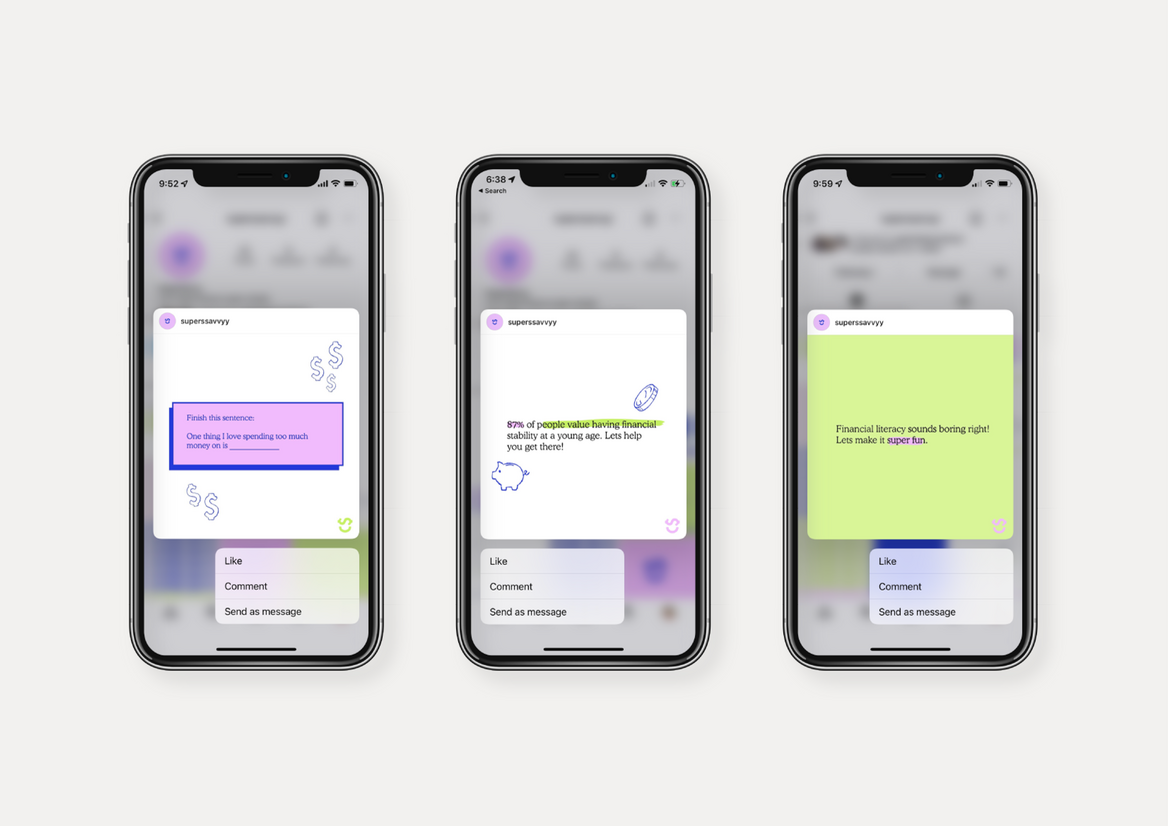

For young adults - approaching finance can sometimes be confronting, daunting, and largely unappealing; yet within a current cost of living crisis, facing finance has never been more critical. Driven by an internal survey, we discovered that 87% of young adults value having financial stability at a young age, and only 11% were satisfied with their financial situation. These statistics became a collaborative motivation to create meaningful social change.

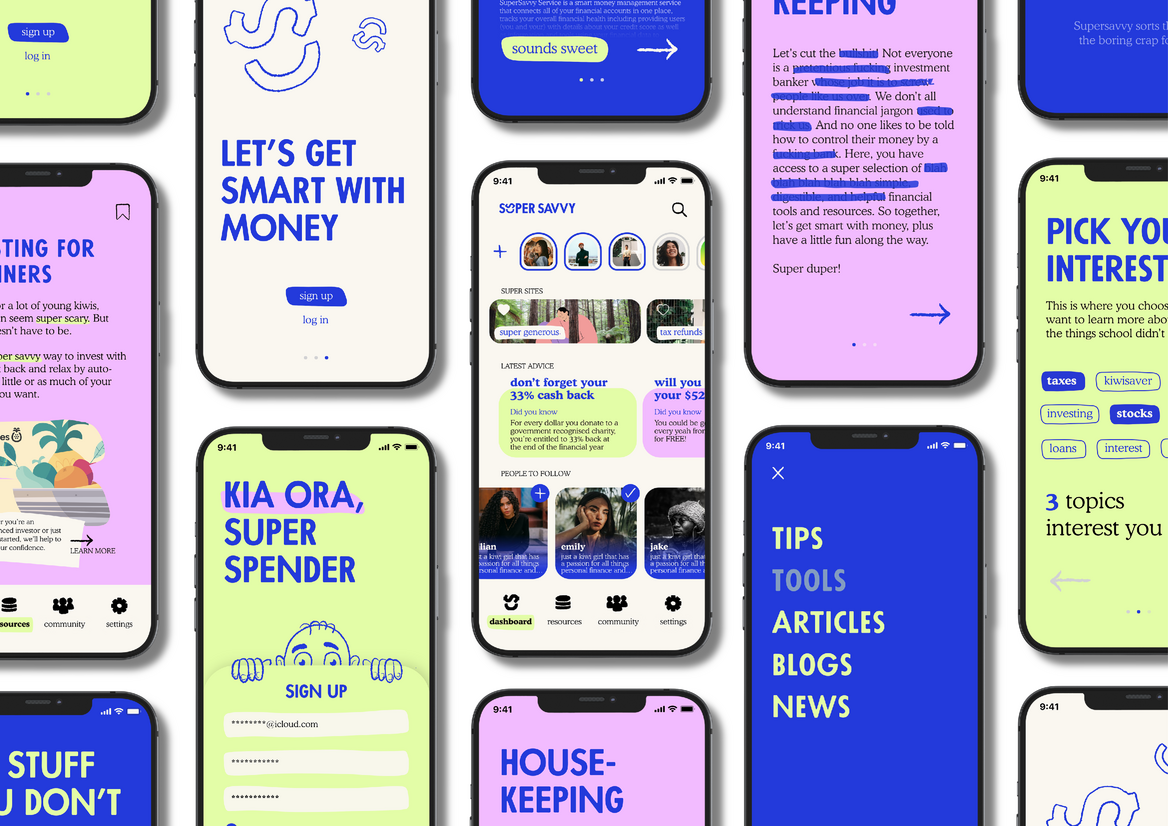

Super Savvy aims to deliver social good through the means of creating playful, approachable yet confident financial literacy, flipping the switch on the dull and clinical existing financial literacy precedents we see in the world today. Our intention centres around targeting and engaging a young adult demographic, whether that be the university fresher or the to-be millennial homeowner, and aims to spark the conversation on finance and challenge the young adult stigma that finance can be boring.

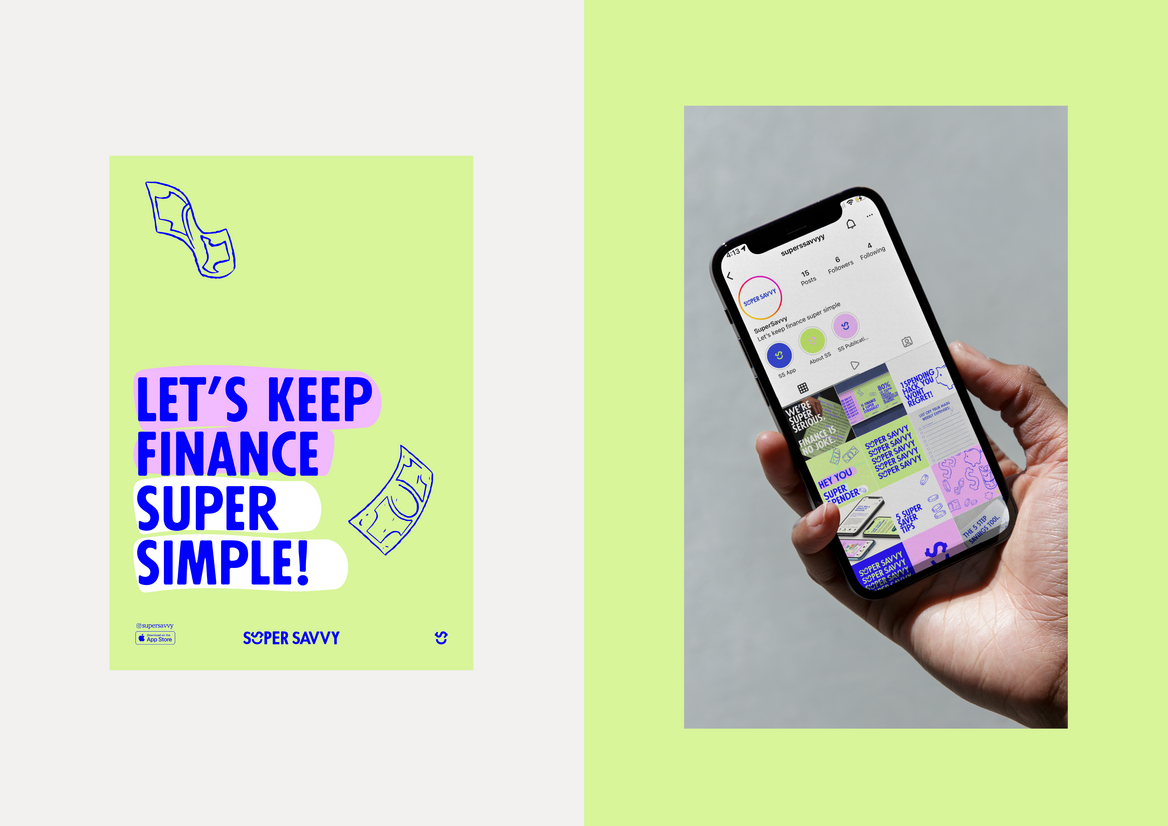

Super Savvy's collateral works as a system; it identifies that a homogeneous output can strengthen the output message as a whole. Super Savvy is presented through collateral such as posters, social media, print publications and responsive UX/UI to create a sense of community for our target audiences and users.

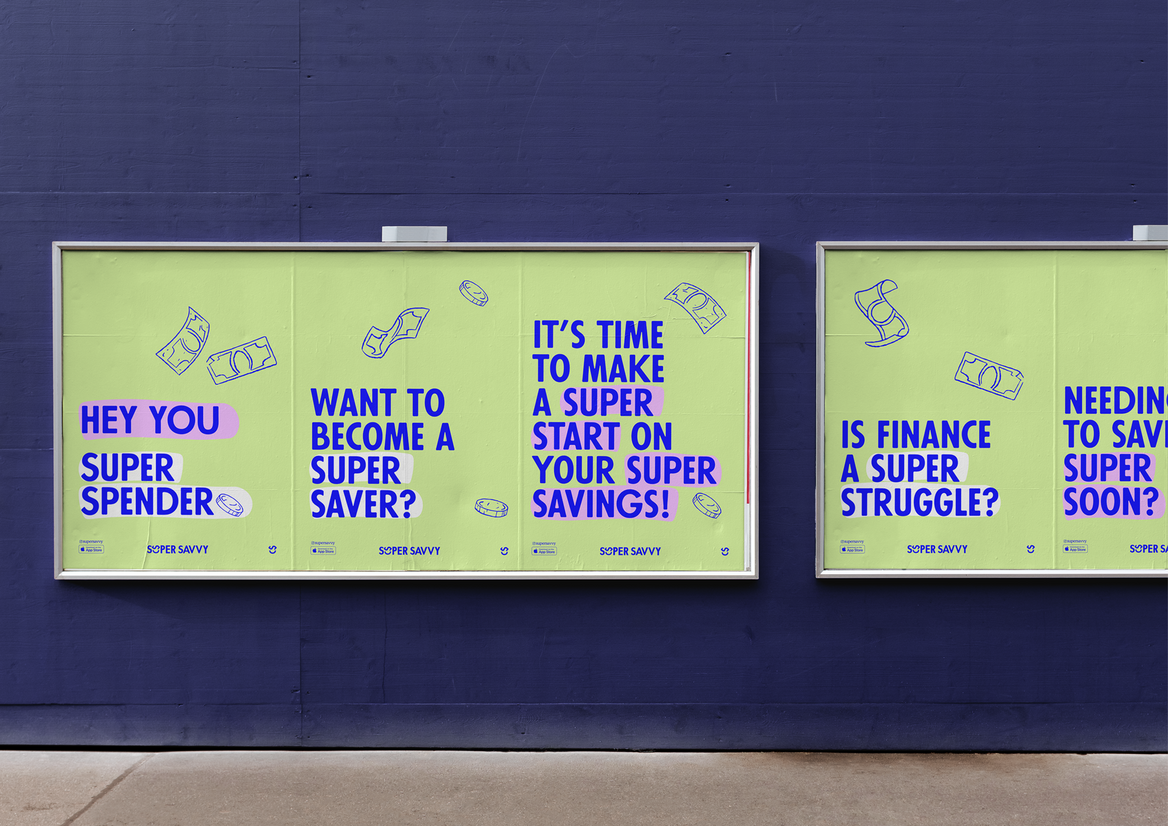

Our poster series and social media campaigns act as the initial engagement between the campaign and the audience. We utilise personified brand language and targeted statements to communicate with our intended audiences. Confident call to action points, playful illustration, colour, and personable copy all lend a hand in encouraging our target audience to engage. The positioning of these mediums within environments such as university facades and social media platforms is a further catalyst for such collateral to be successfully absorbed.

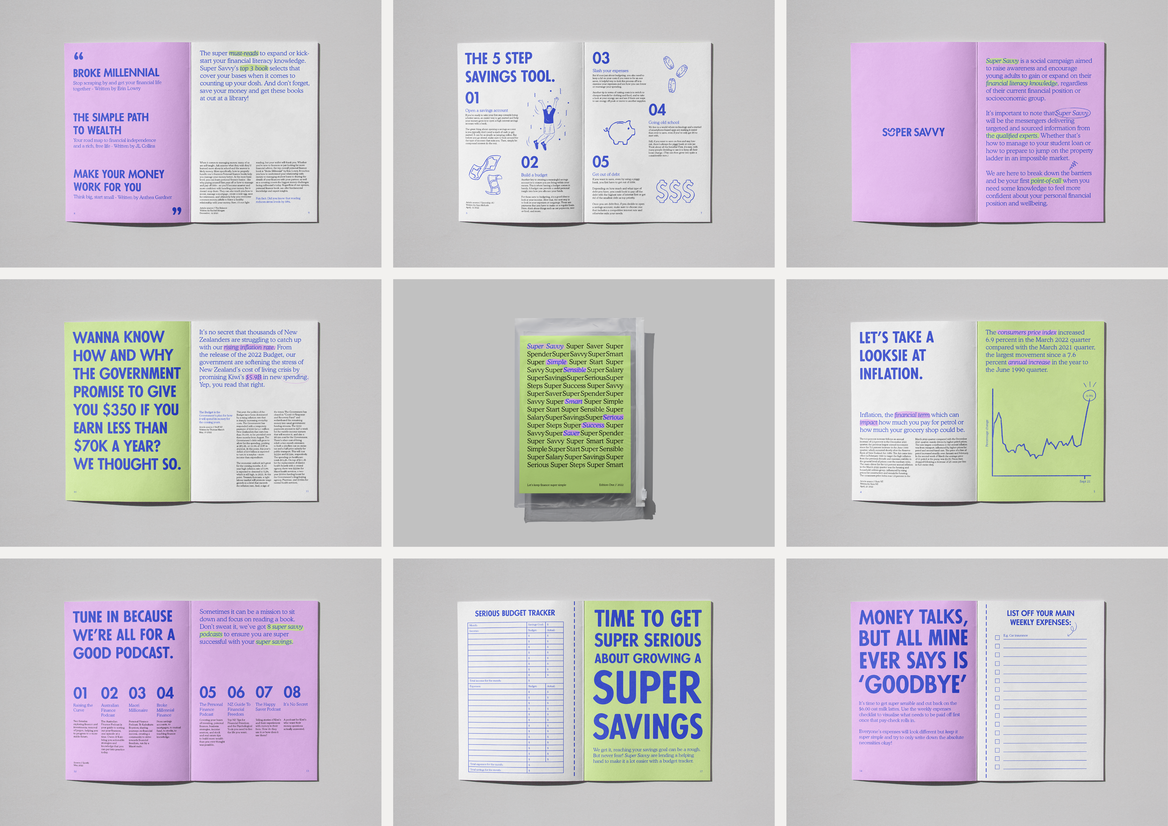

We also discovered that the ability to have tangible resources within an educational space further encouraged the success of education, such as financial literacy, to be adopted, with the collateral of a publication created to allow for a broader reach to our targeted demographic beyond digital platforms. The publication acts as a purposeful educational resource, offering a range of financial literacy aid whilst exhibiting information through approachable and playful deliverables, generating intrigue and engagement with our audience. The publication provides tips and tools through interactive pages to inspire people to take action with the resources they have learnt and apply it to their finances.

The resources within the publication are dually complimented with a responsive app idealised in targeted UX/UI design. Unlike budgeting apps, the Super Savvy app acts as a virtual knowledge nucleus for financial literacy - a pocket-sized community for like-minded young kiwis desiring financial guidance. Creating instant access to blogs, podcasts, and community networks, driven by young kiwis with the tools to further their financial literacy and independence, the Super Savvy app can instil confidence in a target group that has been largely segregated from financial literacy.