Credits

-

Pou Auaha / Creative Directors

Levi Slavin, Maria Devereux (CIO), Simon Vicars (CCO)

-

Ngā Kaimahi / Team Members

Ellen Fromm (Senior Writer), Haylie Craig (Senior Art Director), Harry Skelton (Art Director), Erin Mattingly (Copywriter), Rachel Aikin (Managing Partner), Amanda Brittain (Business Director), Dan O'Leary (Business Director), Sabine Sims (Business Manager), Connor Kilkelly (Producer), Henry Kozak (Strategy Producer), Emma Tait (Digital Strategist), Amy Pollok (Senior Strategist), Tennille Barnes (Head of Digital), Logan Maire (Head of Technology and Innovation), Claudio Varoli-Piazza (Senior Digital Producer), Lauren Orlina (Senior Digital Producer), Jane Coote (Senior Digital Producer), Sonya Milford (Digital UI Designer), Jodie Heron (Digital UI Designer), Gyan Buyan (Senior Developer), Ricardo Grecco (Senior Developer), Ryan Potter (Senior Developer), Bri Russell (Agency Designer), Louise Tummon (Illustration Producer), Nick Chaffe (Illustrator), Fern Holloway (Agency Producer), Ainsley Allen ( Producer, Bunker), Shane Taipari (Sound Design), Samuel Felix (Animation/Editor, Bunker), Arkadi Kravtchouk (Animation/Editor, Bunker), Leo Zarpelon (Animation / Editor, Bunker)

-

Client

Gabrielle Marwick-Brown

Description:

The opportunity:

State Insurance’s target audience is the busiest people in New Zealand.

Its existing brand platform addresses this head on: Insurance for Too Busy Lives.

Customer feedback showed the things that made them stressed weren’t necessarily big insurance claims, but everyday mistakes that added up.

The job to do was to take the ‘Insurance for Too Busy Lives’ platform and move it beyond just a claims moment. The answer was to be helpful all the time, not just when a claim is lodged. To do that, we wanted to prevent claims from happening in the first place.

If we could help New Zealanders make less mistakes, we would be genuinely helpful to our audience, and build brand consideration and brand love.

The Approach:

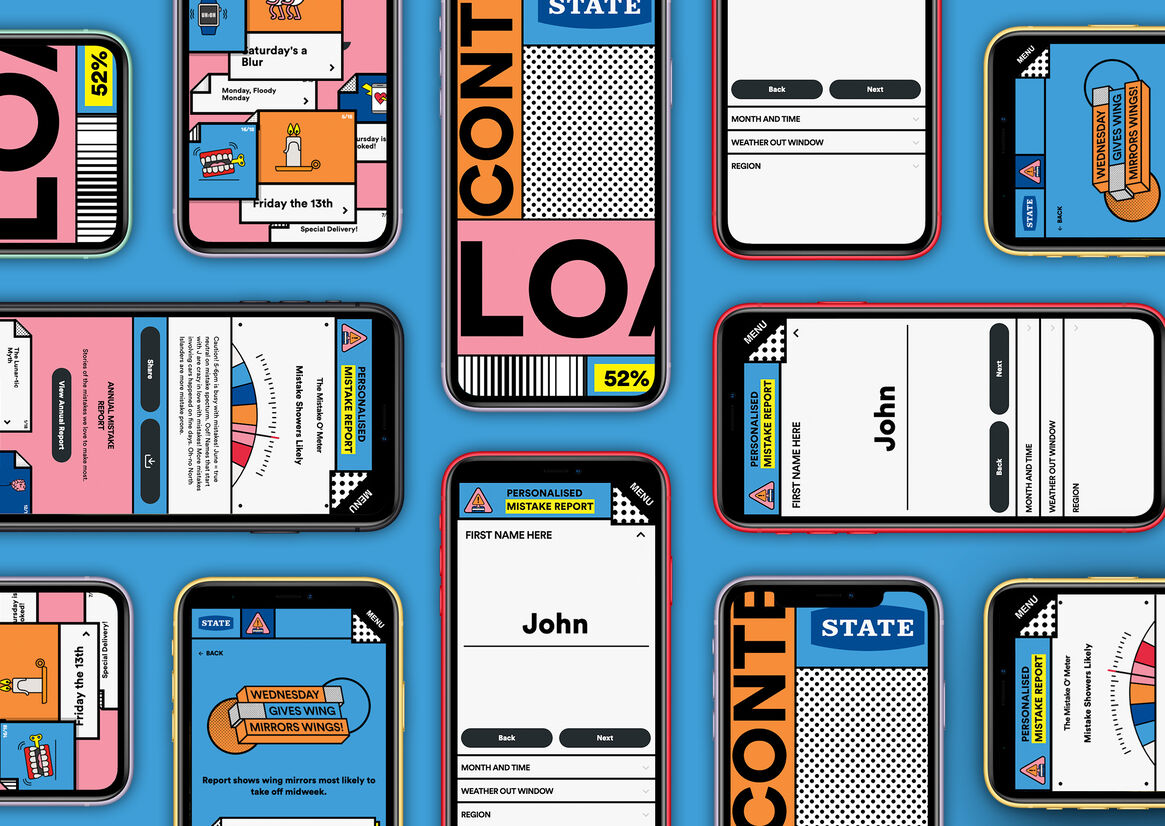

In an industry built on data, so little of it is used to talk to insurance customers, or to create personalised experiences for them. The Mistake Report changes that.

To create the report, State analysed over 4M+ data points from claims, weather, police and transport data to find ‘mistake’ patterns. A targeted campaign warned people of mistakes right before they made them, and directed them to The Mistake Report branded microsite.

Here, they could forecast their own risk through a smart digital tool that analysed personal info and data to calculate anyone’s mistake probability down to the minute.

Playing insurance data directly back to the nation to help them avoid danger and damage created a powerful connection between customer and brand and changed the landscape of insurance in NZ.

The Results:

Over 80% of the nation saw and engaged with The Mistake Report over the course of the campaign. Resulting in a brand consideration lift (the highest in 3 years) and a 14.% reduction in accidental claims — representing hundreds of mistakes avoided and hundreds of thousands of dollars saved.